What is FASTag ? National Electronic Toll Collection (NETC) FASTag

National Payments Corporation of India (NPCI) has developed the National Electronic Toll Collection (NETC) program to meet the electronic tolling requirements of the Indian market. It offers an interoperable nationwide toll payment solution including clearing house services for settlement and dispute management. Interoperability, as it applies to National Electronic Toll Collection (NETC) system, encompasses a common set of processes, business rules and technical specifications which enable a customer to use their FASTag as payment mode on any of the toll plazas irrespective of who has acquired the toll plaza.

FASTag is a device that employs Radio Frequency Identification (RFID) technology for making toll payments directly while the vehicle is in motion. FASTag (RFID Tag) is affixed on the windscreen of the vehicle and enables a customer to make the toll payments directly from the account which is linked to FASTag.

FASTag offers the convenience of cashless payment along with benefits like - savings on fuel and time as the customer does not has to stop at the toll plaza.

- Currently the program is live on toll plazas across the country. Please click here to view the complete list.

- Please click here to view the live banks list.

- Click here to know your Bank UPI Handle and recharge your NETC FASTag with UPI.

- For more information on NETC FASTag, Click here

- Click here To Check Your NETC FASTag Status

- For NETC FASTag queries, please contact your issuing bank customer care number: Click here

Objectives of National Electronic Toll Collection system:

| To create a composite interoperable ecosystem. | Provides an interoperable secure framework capable of use across the country. |

| Simple and robust Framework. | It increases transparency and efficiency in processing transactions. |

| To serve the sub goal of Government of India. | Electronification of retail payments. |

| Reduce air pollution by reducing the congestion around toll plaza. | |

| Reduce fuel consumption. | |

| Reduce cash handling. | |

| Enhance audit control by centralizing user account. |

What is FASTag?

FASTag is a RFID passive tag used for making toll payments directly from the customers linked prepaid or savings/current account. It is affixed on the windscreen of the vehicle and enables the customer to drive through toll plazas, without stopping for any toll payments. The toll fare is directly deducted from the linked account of the customer. FASTag is also vehicle specific and once it is affixed to a vehicle, it cannot be transferred to another vehicle. FASTag can be purchased from any of the NETC Member Banks. If a FASTag is linked to the prepaid account, then it needs to be recharged/ topped-up as per the usage of the customer. If adequate balance is not maintained by the customer, the FASTag gets blacklisted at the toll plaza. In such a scenario if the customer travels through a toll plaza without recharging then he won't be able to avail the NETC services and would be required to pay the toll fare through cash.

Following are some of the key features and functionalities of National Electronic Toll Collection system.

| Transaction Type. | Off-line; near real time transaction processing as the toll plazas send the transactions within 10 mins interval. |

| Interoperability. | NETC ecosystem supports multiple issuers and multiple acquirers' i.e. Tag issued by any member bank is accepted at all toll plaza (under NETC program) acquired by any member bank in a safe and secured manner. |

| Flexibility to choose the underlying payment instruments. | Customers can link their FASTag to their existing savings/current account or to a prepaid account basis the offering from the Issuer member banks. For opening a prepaid account it is not mandatory to have an existing relationship with the issuer bank. |

| Tag Issuance. | Can be issued by member banks, authorized for NETC Program. |

| Cashless Payment. | FASTag facilitates electronic payments at the toll plaza while the vehicle is in motion. |

| Save Time and Fuel. | Customer can travel without stopping at the toll plaza by using the FASTag thus reduce congestion at plazas and , saving fuel and reduce travel time. |

| Recharge FASTag account online. | Customer can recharge FASTag account online through issuing member banks portal using UPI/ Credit Card/ Debit Card/ NEFT/ RTGS /Net Banking. |

NETC FASTag TRANSACTION PROCESS FLOW

The above diagram illustrates transaction flow of the NETC system. The Transaction from the Toll Plaza is sent to the acquiring system. The Acquiring System validates these transactions and send it to NETC Switch. NPCI route these transactions to the respective Issuer Bank which in turn debit the tag holder account.

LEG 1

Whenever the vehicle passes through the ETC lane of the Toll Plaza, the Toll Plaza system captures the FASTag details like (Tag ID, TID, Vehicle class, etc.) and sends it to the Acquiring bank for processing.

LEG 2

The Acquiring bank sends a request to the NETC Mapper to validate the tag details.

LEG 3

Once the Tag ID is validated, NETC Mapper responds with details like Vehicle class, VRN, Tag Status etc. If the Tag ID is absent in NETC Mapper, it will respond that the Tag ID is not registered.

LEG 4

After successful validation of Tag ID from NETC Mapper, acquirer host calculates the appropriate toll fare and initiate a debit request to NETC system.

LEG 5

NETC System will switch the debit request to the respective issuer bank for debiting the account of the customer.

LEG 6

Issuer host shall debit the linked tag holder account and sends a SMS alert to the tag holder. The Issuer host shall send the response message to NETC system. If the response is not sent within the defined TAT, the transaction are considered as Deemed Accepted.

LEG 7

NETC system will notify the response to acquirer host.

LEG 8

Acquirer host will notify to respective toll plaza system.

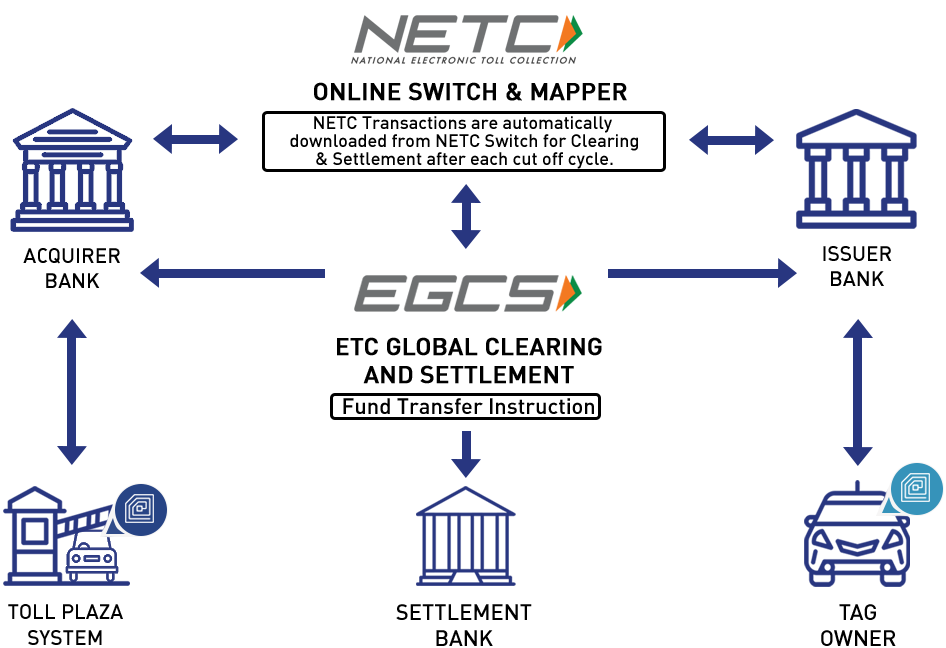

EGCS TRANSACTION PROCESS FLOW

KEY FEATURES OF EGCS SYSTEM

- Transaction auto presented for clearing.

- Debit/Credit Adjustment.

- Complete Dispute Management.

- Multiple Settlement Cycle.